Regulation A+ offerings provide investors with a novel opportunity to participate in early-stage companies. However, the question persists whether Regulation A+ is truly a viable solution for both firms seeking funding and backers looking for profit.

Some argue that Regulation A+ expedites the fundraising process, making it vastly accessible to a wider variety of companies. Proponents point to the capability for enhanced capital formation and employment opportunities.

On the other side, critics express concerns about the sophistication of Regulation A+ compliance, arguing that it can be a hindrance for smaller companies. Critics also challenge the suitability of Regulation A+ in attracting institutional capital.

Ultimately, the viability of Regulation A+ depends on a range of factors, such as market conditions, investor perception, and the proficiency of companies to effectively leverage this regulatory framework.

Regulation A+ | MOFO delve into

Regulation A+ is a mechanism established by the Securities and Exchange Commission (SEC) to facilitate smaller companies in raising capital. Essentially, it grants businesses to offer securities to the public through a streamlined registration process. The aim of Regulation A+ is to provide an reasonable pathway for companies to attract funding, thereby boosting economic growth and development. MOFO has a experienced team of attorneys versed in Regulation A+ who can advise companies during the entire process, from initial conception to final registration.

Dive into Title IV Regulation A+ about you | Manhattan Street Capital

Regulation A+, a subsection of Title IV of the Securities Act of 1933, provides an pathway for businesses to secure capital from the general investing populace. This adaptable method permits acquiring up to fifty million dollars from offerings according to a streamlined procedure. Manhattan Street Capital acts as a resource for entrepreneurs to leverage Regulation A+ and reach out to potential {investors|.

Manhattan Street Capital's expertise of the nuances of Regulation A+ strengthens companies with the tools they need to efficiently execute their financing.

Cutting-Edge Reg A+ Offering

Reg A+ has evolved, providing entrepreneurs with a dynamic pathway to attract capital. This transformative solution facilitates companies of all scales to unlock the public markets with enhanced flexibility.

Via Reg A+, companies can issue their securities openly to a larger investor base, driving growth and development.

This modernized approach offers significant benefits compared to traditional financing methods.

Some highlights include:

- Lowered regulatory burdens

- Budget-friendly capital raising

- Elevated investor reach

- Heightened corporate framework

Overall, the new Reg A+ solution represents a compelling alternative for companies seeking to secure funding.

Need to Know About Regs - Our Collection

Alright listen up, folks. Let's talk about Regs. You know, those things that are vital for keeping things running. Well, let me tell you, we have a enormous selection of Regs. Whether you need a classic Reg or something more unique, we've got you covered. Our inventory is second to none, so come on down and browse what we have to offer.

- We've got Regs for all your needs.

- We offer competitive pricing on all our Regs.

- Stop by today and see what we've got.

Leveraging Regulation A+

Regulation A+ presents a unique avenue for startups to attract capital from the public. This framework allows companies to issue their securities to a broader audience, including individuals. Startups exploring Regulation A+ should thoroughly review its guidelines and benefits. It's essential to consult with financial professionals to guarantee compliance and maximize the benefits of this powerful fundraising tool.

- Key considerations for startups involve an nature of the registration process, client measures, and ongoing reporting obligations.

- Successful Regulation A+ efforts often require a well-developed operational plan, a convincing investment proposal, and solid investor engagement strategies.

How Regulation A+ Works with Equity Crowdfunding streamlines

Regulation A+, a type of funding mechanism offered under U.S. securities law, has revolutionized the way companies can raise capital through equity crowdfunding. In essence, it allows businesses to sell securities to the public in a more accessible and cost-effective manner than traditional methods. By leveraging online platforms, Regulation A+ enables companies to tap into a broader investor base, democratizing access to funding opportunities. This groundbreaking initiative has significantly changed the landscape of fundraising for startups and small businesses, providing them with a viable alternative to venture capital or angel investors.

One key aspect of Regulation A+ is its tiered structure. Companies can choose to raise up to $20 million in a 12-month period through Tier 1 offerings, while Tier 2 allows for an even greater pool of capital, reaching up to $75 million over a longer timeframe. These flexible tiers cater to the diverse needs of businesses seeking funding at different stages of growth.

Moreover, Regulation A+ establishes clear regulations for disclosures and reporting requirements, ensuring transparency and investor protection. Companies are required to provide comprehensive financial statements, business plans, and other relevant information to potential investors, allowing them to make informed choices. This emphasis on disclosure builds trust and confidence in the marketplace, fostering a more robust and sustainable crowdfunding ecosystem.

The Regulation A+ FundAthena offering

FundAthena's Equity Raise represents a significant milestone for the company. By leveraging Regulation A+, FundAthena can attract capital from a wider pool of investors. This methodology allows FundAthena to {expandits operations, develop new products, or fund research and development. The proceeds raised through the offering will be utilized towards key initiatives.

- FundAthena's commitment to transparency is evident in its detailed information pack

- Supporters can review these documents on the official platform.

- FundAthena welcomes early engagement from potential stakeholders.

Special purpose acquisition company

A blank-check company, sometimes referred to as a SPAC, is a publicly traded entity formed with the sole intention of acquiring an existing private company. These companies raise money through an initial public offering (IPO) and then allocate the funds to acquire a target company within a limited timeframe. The combination allows the target company to list its shares without undergoing the traditional IPO process.

Proprietary Stock Securities

Colonial stock securities represented the early instruments of finance in provisionally acquired territories. Promulgated by agents, these shares granted patrons a claim to potential profits derived from territorial expansion. Regularly tied to the cultivation of agricultural products, colonial stock securities became an emblem of the economic ambitions of the colonizing power.

Look What We Found

It’s insane! We finally discovered a killer reg. This thing is out of this world. The specs are phenomenal, and it’s definitely going to boost our arsenal.

We can’t wait to give you a glimpse of this treasure. Stay tuned for details. It’s going to be legendary!

Unveiling Title IV Reg A+ - Crowdfunder Blog

Are you excited to explore the world of investment? Then our latest infographic on Title IV Reg A+ is a must-see! This compelling visual breaks down the essentials of this groundbreaking funding strategy, making it accessible to investors.

- Discover how Title IV Reg A+ enables startups to raise funding from the general population.

- Delve into the benefits of this alternative funding option for organizations.

- Gain valuable insights about the process involved in a Title IV Reg A+ campaign.

Don't miss this chance to deepen your awareness of Title IV Reg A+. Tap the link below to view the infographic today!

Regulation A+ - Securex Filings LLC

Securex Filings LLC provides an experienced firm specializing in detailed process of submitting Regulation A+ proposals. Their team of experts utilizes deep knowledge of the regulations surrounding Regulation A+, allowing them to guide companies through each phase with accuracy.

- Securex Filings LLC offers a diverse selection of services related to Regulation A+ documents, like.

- They work closely of all sizes to prepare compelling Regulation A+ statements.

- They aim to facilitate capital raising for businesses via

Discover Crowdfund.co Currently

Crowdfund.co is a vibrant online platform where passionate individuals and innovative projects connect. Whether you're searching to contribute your next dream or you're thrilled to be a part of something unique, Crowdfund.co offers a abundance of choices.

- Discover a varied range of campaigns spanning across fields.

- Engage with creators and learn more about their stories.

- Contribute in projects that motivate you and be a part of their success.

Be part of the Crowdfund.co community today and experience the power of collective change.

The Fundrise Reg A+ Offering

Fundrise's Reg A+ campaign presents a unique opportunity for investors to access shares in a diverse portfolio of commercial assets. This approach allows for open market investment opportunities traditionally limited to accredited investors. By leveraging the Reg A+ regulation, Fundrise makes real estate opportunities accessible to a broader range of investors.

- Essential features of the Fundrise Reg A+ offering include:

- Spread across multiple real estate classes

- Clarity in terms of investment performance and activities

- Accessibility to a wider range of participants

The Securities and Exchange Commission

The Commission is an independent agency of the United States government. Its primary purpose is to protect investors, maintain fair and orderly trading, and facilitate capital formation. The SEC has broad regulatory authority over a wide range of financial instruments and activities, including stocks, bonds, mutual funds, and investment advisers. It implements federal securities laws and regulations through investigations, litigation, and enforcement.

Raising Capital through Reg A+ and CrowdExpert

Securing funding can be a complex process for businesses, especially when it comes to reaching the suitable investors. Raising Capital through Reg A+ and CrowdExpert offers a innovative solution by leveraging the power of digital networks to connect companies with a broad pool of interested parties.

This system allows investors to invest in promising initiatives, while startups can obtain investment by tapping into a varied network of investors. Title IV CrowdFunding Platform for Reg A+ Offerings streamlines the funding cycle by offering a transparent and compliant structure.

With their dedication on regulations, Title IV CrowdFunding Platform for Reg A+ Offerings provides a secure environment for both backers and companies.

Checking the Waters

Before launching headfirst into a project, it's often wise to feel out the waters. This involves incrementally examining the landscape to get a better understanding of what to anticipate. It's a way to minimize potential pitfalls and maximize your chances of success.

Fundraising for Everyone

Today, crowdfunding has become a viable solution for individuals of all types to obtain funds for their projects. It's no longer solely about tech startups or creative endeavors – it's a powerful tool that can transform ideas across a multitude of industries. From community initiatives to social causes, crowdfunding is democratizing access to capital and giving people the power to drive their own outcomes.

- Empowering individuals|Unlocking potential

- Bridging funding gaps|Reaching ambitious goals

- Building communities|Connecting passionate supporters

StreetShares

StreetShares is a/offers/provides a unique/innovative/progressive platform that connects/facilitates/bridges small businesses/entrepreneurs/companies with investors/lenders/capital providers. It focuses/specializes/targets in veteran-owned/small/local businesses/enterprises/companies, providing them/offering support to/assisting with access to capital/funding opportunities/financial resources. Through its online/digital/web-based platform, StreetShares streamlines/simplifies/expedites the lending/investment/financing process, making it/becoming a/increasingly accessible/affordable/transparent for small business owners/entrepreneurs/companies.

Furthermore/Additionally/Moreover, StreetShares promotes/encourages/supports community/economic/local development by investing in/partnering with/supporting underserved communities/veteran-owned businesses/small businesses. Its mission/goal/objective is to empower/foster/cultivate growth/success/thriving among small businesses/companies/enterprises.

Accessing Growth Through Regulation A+ Avenues

Regulation A+, a unique legal framework within the securities, presents a compelling pathway for companies to raise considerable capital from the mass market. Unlike traditional funding approaches, Regulation A+ allows registered companies to utilize the power of a large-scale initiative. This approach offers several advantages, including increased investor reach, reduced regulatory burden, and boosted brand visibility.

A successful Regulation A+ initiative often involves a meticulous plan that covers several key factors: Meticulous examination to ensure consistency with regulatory requirements, a clear offering document that effectively communicates the company's vision and forecasts, and a robust communications plan to mobilize potential investors.

Regulation A+ can be a transformative mechanism for businesses seeking growth. By harnessing this unique capital market opportunity, companies can tap into the power of the public markets to fuel their objectives.

SEC EquityNet

EquityNet is a/provides access to/acts as a gateway for investors seeking/interested in/looking for opportunities in/within/across private companies. Through its online/digital/web-based platform, EquityNet facilitates/streamlines/connects the process/system/mechanism of investing/capital allocation/funding by bringing together/matching/pairing investors with vetted/screened/qualified companies seeking capital/funding/investment. The platform/site/network offers a wide range/variety/diverse selection of investment opportunities across various industries/spanning multiple sectors/covering diverse fields.

Investors can utilize/have access to/benefit from comprehensive company information/detailed profiles/in-depth data on listed companies/participating businesses/featured firms. EquityNet also provides/further offers/includes resources and tools to help/assist/guide investors make informed decisions/navigate the investment process/conduct due diligence.

Issuing Regulation A+ Rules

Regulation A+, a capital raising mechanism within the U.S. securities laws, empowers private companies to secure capital from the public in a streamlined manner. This offering system is governed by specific rules and regulations designed to ensure investor protection while enabling broader market access for emerging businesses. Regulation A+ supplements traditional IPO processes by providing a less complex pathway for companies seeking capital, particularly those in early stages of growth.

Key features of Regulation A+ include limitations on the amount of capital that can be raised and specific disclosure needs to provide investors with transparent information about the company and its offerings. Furthermore, companies adhering with Regulation A+ must also undergo a examination process conducted by the Securities and Exchange Commission (SEC) to ensure compliance with all applicable provisions.

Understanding Regulation A+ as well as Crowdfunding Regulation A Offering Requirements|Guidelines|Provisions

Regulation A+ crowdfunding presents a unique opportunity for companies to raise capital from the public. However, it's crucial to thoroughly understand the stringent regulatory requirements that govern these offerings. First and foremost, companies must|Companies are required to|A key aspect of Regulation A+ is that companies must fileshould submitare obligated to submit a comprehensive offering statement with the Securities and Exchange Commission (SEC). This document provides essential disclosure concerning the company's business, financial position|performance|health, and the terms of the offering.

Furthermore, companies must comply with a number of other regulations, including those relating to investor safeguards. It's highly recommended that companies seek guidance from experienced legal and financial advisors to successfully complete the Regulation A+ process.

Regulation a+ Investopedia

Investopedia clarifies regulation as the act of establishing rules by authorities to guarantee order in financial markets. Regulation, a+ Investopedia, functions a crucial role in defending investors and fostering market integrity. It seeks to mitigate manipulation while stimulating investment.

Investopedia's resources on regulation provide a in-depth explanation of different regulatory structures across diverse industries.

Furthermore, Investopedia's platform provides a useful tool for investors, firms and regulators to stay informed on the latest developments in the regulatory landscape.

Regulation A+ Companies Overview

A Governance A+ company is a label that indicates a high level of adherence with industry norms. These companies evidence robust internal controls and dedicate to ethical and clear business operations. Achieving this distinction often involves a rigorous assessment process conducted by independent organizations.

- Advantages of being a Supervision A+ company include improved brand image and greater stakeholder trust.

- Moreover, Supervision A+ companies often benefit from favorable lending terms.

The supervision landscape is constantly evolving, so ongoing development is essential for maintaining this respected position.

Regulation + Real Estate

The combination of regulation and real estate is a complex landscape. Landlords must comply with a web of local, state, and federal|national|state and federal regulations. These guidelines impact numerous aspects of the real estate sector, including {propertyownership. Furthermore, understanding these regulations is vital for all|individual homeowners and large real estate companies.

Real estate {professionals|agents, brokers, attorneys] play a key role in informing clients on adherence with real estate {regulations|.

Recognizing the dynamic nature of real estate regulation is essential for achievement in this demanding field.

First Time IPO First JOBS Act Company Goes Public Via Reg A+ on OTCQX

We are thrilled to announce that our company has made a triumphant entrance into the public market via a Regulation A+ offering on the OTCQX platform. This landmark event marks a significant milestone for our company, which was established under the provisions of the JOBS Act, a revolutionary piece of legislation designed to support small businesses in raising capital through direct public investment.

This Reg A+ offering provides us with valuable capital to further develop our innovative solutions. We are incredibly grateful for the confidence of our investors who have believe in our vision.

We look forward to continue to grow and innovate with all our stakeholders.

FundersClub enables Reg A+ campaigns on the platform

FundersClub, a leading online marketplace for startups, is now supporting companies to conduct Reg A+ investments directly on its portal. This move will grant startups access to a broader group of investors, comprising accredited and non-accredited individuals.

Reg A+ is a law that enables companies to raise capital from the public in exchange for equity. FundersClub's implementation of Reg A+ presents startups a simplified process for conducting their investment rounds.

- With this new offering, startups can reach a wider audience and bolster their growth.

- FundersClub's robust infrastructure will guide companies across the Reg A+ journey.

- {Additionally|, Moreover,Furthermore, FundersClub's knowledgeable team will extend mentorship to startups on conquering the challenges of Reg A+

Understanding Reg A Plus

Regulation A+, also known as Reg A+, is a mechanism of the Securities Act of 1933 that allows companies to raise capital from the public through the issuance of securities. Unlike traditional IPOs, Reg A+ offers a more streamlined process for smaller businesses to go public. Companies utilizing this regulation can offer their securities to a broader range of investors, including both accredited and non-accredited individuals.

Reg A+ is often considered as an alternative to traditional IPOs due to its relatively minimal costs and regulatory burden. This makes it an attractive option for startups and emerging companies looking to raise capital without the complexities and expenses of a full-scale public offering.

- Advantages of Reg A+ include increased access to capital, broader investor base, and a simplified procedure.

Regulating A+ Crowdfunding Platforms

The burgeoning sector of A+ crowdfunding platforms presents both ample opportunities and unique challenges. Consequently, regulators are actively scrutinizing various frameworks to promote the prudent growth of these platforms while safeguarding contributors. A key priority is creating clear regulations that balance the requirement for development with the imperative to mitigate risks.

- Furthermore, regulators must address the nuance of A+ crowdfunding models, which often involve layered arrangements.

- This demands a coordinated approach involving regulators, industry players, and consumer groups to craft effective regulatory frameworks.

Regulation A+ Summary

A Regulation A+ summary provides a comprehensive overview of a company's business, financial condition, and offering. This document is essential for potential investors as it helps them understand the risks and potential returns associated with investing. The summary must concisely disclose key information in a accessible format to ensure transparency and well-considered choices.

- Moreover, the Regulation A+ summary must adhere to specific regulatory requirements set by the Securities and Exchange Commission (SEC). These requirements ensure that the information provided is accurate, comprehensive, and devoid of fraudulent or deceptive content.

- As a result, a well-crafted Regulation A+ summary is an crucial tool for both {companies seeking capital and investors looking to participate in the offering. It fosters transparency, promotes informed investments, and contributes to the integrity of the capital markets.

Governance A+ IPO

Navigating the intricacies of a Regulation A+ IPO can be daunting for companies. Acquiring regulatory approval is essential to ensure a successful offering. Companies must carefully comply with all applicable rules, including those concerning to financial reporting. A robust legal framework is vital for mitigating risks and creating shareholder assurance.

- Key considerations include market analysis, business planning, and strategic outreach with potential investors.

- Openness is vital throughout the process, ensuring clients with accurate information to make informed decisions.

By a thorough understanding of the regulatory landscape and strategic execution, companies can succeed in a Regulation A+ IPO successfully.

Transactions A+ Guidelines

Regulation A+ offerings are a avenue for small businesses to obtain capital from the public. These regulations are meant to facilitate the fundraising process while securing investor security. A+ regulations typically involve a comprehensive registration statement and ongoing disclosure obligations.

- Fundamental elements of Regulation A+ include boundaries on the amount of capital that can be obtained, specifications for investor transparency, and procedures for ongoing adherence.

- Adherence with Regulation A+ rules is crucial to mitigating legal challenges. Businesses considering a Regulation A+ offering should consult expert legal counsel to ensure adherence with all pertinent regulations.

Requirements for Offerings

When embarking on an offering release, it's imperative to comply with the relevant regulatory requirements. These frameworks promote fairness, openness and protect both stakeholders and the broader ecosystem. A comprehensive understanding of these responsibilities is vital to executing a successful offering.

- Key aspects of offering regulation encompass transparency requirements, approval procedures, and adherence with investment laws.

- Furthermore, guidelines may change depending on the type of offering, jurisdiction, and other considerations.

Therefore, it's greatly suggested to engage experienced regulatory professionals to confirm full compliance and mitigate potential risks.

Navigating A+ Crowdfunding within SlideShare

The landscape of crowdfunding is rapidly changing, with platforms like Kickstarter and Indiegogo gaining traction. A+ crowdfunding, a unique segment within this realm, provides unique benefits for both fundraisers and backers. SlideShare emerges as a valuable platform for exploring the intricacies of A+ crowdfunding regulation.

- SlideShare presentations often function as detailed guides, illuminating the legal framework governing A+ crowdfunding.

- Regulatory insights are readily available on SlideShare, sharing valuable perspectives on regulations within this dynamic sector.

- By utilizing SlideShare's vast library of presentations, both entrepreneurs can improve their understanding of A+ crowdfunding regulation and steer a successful course within this thriving market space.

The JOBS Act's Regulation A+ Tier 2 Offering

Under this landmark Job Creation Stimulating Act , Congress enacted Regulation A+, a tier 2 offering structure. This regulatory framework allows growing businesses to attract investments from the investment community by issuing shares. In order to be eligible, companies must meet certain financial and operational criteria, guaranteeing their capacity for repayment.

A Reg A+ Tier 2 offering typically involves a more comprehensive vetting procedure and information sharing protocol. Thus, this tier of offering is often perceived to be more ideal for mature businesses with a established history.

Rule A Text

Regulation A text refers to the rules and regulations governing public companies. It provides specific information about how raising capital through private placements. Companies adhering to Regulation A must provide specific disclosures with the Securities and Exchange Commission (SEC) to ensure transparency. Understanding Regulation A text is important in companies seeking to access public capital markets.

- Fundamental elements of Regulation A text include: restrictions regarding investment

- Eligibility criteria that companies must fulfill to participate in Regulation A.

- Consumer rights that are enshrined within the regulation.

Regulation A+ Offering

A regulation A+ offering is a solution designed to help businesses in adhering to strict compliance requirements. It provides a comprehensive structure for controlling liability, ensuring businesses adhere to the strictest standards. This offering often includes tools, resources, and development to assist businesses in obtaining audit readiness.

Supervision a Plus

In today's dynamic market landscape, comprehensive regulation is crucial. A sound regulatory framework facilitates transparency, securing both consumers and the health of financial markets. Regulation a plus means going above and beyond the minimum requirements to foster innovation while reducing potential threats. This strategic approach leverages regulatory tools to propel economic expansion, finally benefiting all parties.

Regulation A

When investigating funding options, two key regulations stand out: Regulation A and Regulation D. Both provide a means for companies to raise capital from the public, but they have unique attributes. Regulation A, often referred as "mini-IPO," is a structured system that allows retail companies to raise up to millions of dollars. In contrast, Regulation D is focused on private placements, allowing companies to attract investment from accredited investors.

- Regulation D is a more open process, while Regulation D enforces confidentiality.

- Regulation D typically demands greater disclosure, whereas Regulation D has less stringent requirements.

The choice between Regulation A and Regulation D relies on a variety of elements, including Jobs act Tycon SEC the scale of funding needed, the business's stage of maturity, and the level of public exposure.

Directive A

The Federal Reserve Board (Institution) Regulation A is a regulation issued by the Federal Open Market Committee (Council) that aims to ensure the soundness of the financial market. It primarily focuses on regulating banks and their operations to protect consumers and maintain the integrity of the banking sector.

- The Directive establishes specific standards for capital adequacy, lending practices, and risk management.

- Moreover, it mandates regular filings by institutions to the Board to ensure compliance.

- The goal is to promote a safe and reliable financial system while fostering financial innovation.

Securities Regulatory Body Approves New “Reg A+” Rules for Crowdfunding

The Financial Regulatory Body, in a landmark decision, has ratified new regulations for Regulation A+, referred to as "Reg A+". This revision aims to enhance the crowdfunding process for businesses, making it accessibility and attracting more investors.

Through these new regulations, companies can now secure up to $50 million in investment from the public, markedly enhancing the opportunities for growth and development. The SEC's decision is expected to fuel the crowdfunding industry, offering a valuable alternative for businesses to access capital.

This updated system will possibly result in increased competition within the crowdfunding space.

A+ and D Regulations

When exploring methods for raising capital in the United States, companies frequently encounter two prominent regulations: Regulation A+ and Regulation D. These regulations establish specific requirements for public and private offerings of securities. Regulation A+, often referred to as a "mini-IPO," permits companies to raise capital from the general public, while Regulation D focuses on private placements limited to accredited investors. A key distinction lies in the level of funding permissible under each regulation. Regulation A+ enables companies to raise up to $50 million per year, offering a potentially larger pool of capital compared to Regulation D. However, Regulation A+ involves more stringent disclosure requirements, necessitating greater adherence to public company standards.

Within Regulation D, Rule 506(c) and 506(d) present distinct strategies for conducting private placements. Rule 506(c) permits offerings solely to accredited investors via a general solicitation, provided that the issuerundertakes due diligence on all investors. In contrast, Rule 506(d) allows for offerings to both accredited and non-accredited investors but restricts general solicitations. This distinction emphasizes the subtleties inherent in navigating private placement regulations.

Regulation D Offerings - 506(b) vs 506(c)

When navigating the complex world of private investments, understanding Regulation D and its intricacies is paramount. Within this framework, Rule 506(b) and Rule 506(c) offer distinct pathways for raising capital, each with its own set of requirements. Rule 506(b) generally permits entities to raise funds from an large number of accredited investors and up to ten non-accredited investors, while Rule 506(c) exclusively caters to accredited investors. Key distinctions include the need for due diligence, disclosure documents, and ongoing reporting obligations, which vary between the two rules. A comprehensive grasp of these nuances is crucial for companies seeking to utilize Regulation D offerings effectively.

- Regulation D offers various pathways for companies to raise capital from private investors.

- The rules offer various methods for raising capital through private offerings.

- Rule 506(b) allows for up to thirty-five non-accredited investors, while Rule 506(c) exclusively allows accredited investors.

Leveraging Opportunities With Regulation A+

DreamFunded provides a comprehensive suite of tools specifically designed for companies exploring Regulation A+ as a funding strategy. Our network offers comprehensive manuals on all aspects of Regulation A+, from compliance to promotion. Whether you're at the initial stages of your journey or nearing a public offering, DreamFunded has the knowledge to help you master this complex legal landscape.

- Gain dedicated legal and financial consultation

- Connect with other companies embarking on Regulation A+

- Learn the intricacies of Regulation A+ submissions

Fundraising

The landscape of entrepreneurial finance has been revolutionized by the rise of crowdfunding platforms and the JOBS Act. EquityNet, coupled with innovative capital raise models like Reg A+ and Regulation D, have empowered startups to access angel investors from a wider pool of backers. Goldman Sachs and other traditional banks are increasingly embracing these models, recognizing the potential of debt crowdfunding to fuel growth in seed stage companies.

Platforms like GoFundMe, which cater to diverse capital requests, have democratized the process, allowing everyday people to participate in the success of energy companies. AngelList connect business owners with angel investors and venture capitalists, facilitating deals that once required navigating complex financial markets. The Reg A|'s role in defining the regulatory framework for these platforms is crucial to ensuring investor protection and market integrity.

Platforms like MicroVentures are at the forefront of this movement, offering a spectrum of investment opportunities. Cash From the Crowd specialize in connecting borrowers with investors for equity investments. The rise of digital finance has created a dynamic ecosystem where innovation and investment converge.

The future of investment is undoubtedly evolving, driven by technology, regulatory changes, and the growing demand for alternative investment vehicles.

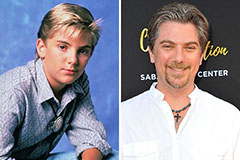

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!